Before the pandemic, the pharmaceutical industry experienced a relatively stable global supply chain, with the most common challenges generally coming from either inventory or compliance issues. These problems shifted dramatically around the world during the outbreak of COVID-19 in late 2019 in China and globally in 2020, which required a radical rethinking of distribution methods.

As a result, many new questions were raised about how to continue allowing workers to produce goods. Richard Locke, professor of political science and international affairs at Brown University, explained that some companies doubled down on exploitative working practices, using “essential worker” laws to bypass government legislation, while others were more considerate about the health of their employees and reduced the on-ground staff. During this time, employee morality actually increased fortyfold during the pandemic, and workers in the logistics industry were hit the hardest.

The pharmaceutical industry then entered a period of intense and deliberate innovation. This included adapting to new demands, resulting in a post-pandemic landscape that looks very different from the one we were familiar with just 5 years ago. These changes spanned a wide range of activities, from the manufacturing and processing of healthcare products (drugs, medical devices, and equipment) to their subsequent transportation and distribution. Even the regulatory environment that pharmaceutical companies operated within varied widely from country to country and was often disrupted by rapid changes while shipments were still en route to their destination.

Remnants of the pandemic could still be seen in the winter of 2023, as China began to dismantle its lockdown procedures, leading to a large wave of infections impacting the ability of medical factories to deliver goods that were intended to make up a large portion of the United States’ medical supplies. This forced the U.S. government to implement stockpiling measures to ensure that supplies remained at consistent levels to combat potential shortages. Depending on the type of medication, this could mean keeping large quantities of certain goods, such as the COVID-19 vaccine or insulin, at a consistent temperature, having a knock-on effect on storage rates for the pharma cold chain as well.

It’s not just the United States facing this issue, either. China actually supplies most of the world with active pharmaceutical ingredients (API), which are the raw components of the medications we use. This means that any change in the supply chain in China automatically has a ripple effect around the world, leaving many countries in the process of “de-risking” their supply chain by decoupling their production from China-dependent ingredients.

These occasional post-pandemic waves have shaken the stability of the global pharmaceutical supply chain over the past four years. In this article, we’ll take a look at some of the major changes that took place during the onset of COVID-19 and the subsequent technologies that have emerged to reshape the post-pandemic logistics industry and combat these upheavals.

The impact of the pandemic on the pharmaceutical logistics industry

Around the world, people watched as the pandemic affected the way medicines and medical supplies were transported, stored, and managed. Most of us remember empty aisles of tissue paper, disinfectant, and healthcare supplies at stores while hospitals also began asking the public for donations. Everything was in short supply.

However, the scale of these disruptions is often hard to imagine without an understanding of the key consequences. If we look at recently published medical research, the National Library of Medicine found that nearly 75% of companies experienced supply chain disruptions during the pandemic, while 80% expected future disruptions. Delays in receiving goods were also reported by 62% of companies, and 53% experienced difficulties in obtaining information from China, a major hub for pharmaceutical manufacturing and distribution.

As Katherine O’Brien, the World Health Organization’s (WHO’s) Head of Immunization, explained in a press release during the crisis, “This is no small undertaking. And even the most prepared, the highest capacitated countries, are struggling to deliver these vaccines in the dimension, the age groups and the scope that is needed.” In March 2020, the WHO also called for medical manufacturers to increase production by 40% to help ease medical supply shortages.

Although their demand for more medical supplies was straightforward, manufacturers found it difficult to maintain pre-pandemic production levels due to the ongoing supply chain disruptions. The scale of this struggle forced government and private stakeholders to come together to create Operation Warp Speed (OWS), which established an enduring partnership between manufacturers and the U.S. government and provided $12 billion in funding to accelerate the development of a vaccine, with up to $100 million available to companies such as Corning, Cytiva, Emergent BioSolutions, and Fujifilm’s Diosynth Biotechnologies.

Due to the severity of these ongoing disruptions, the pandemic has led 40% of supply chain leaders to begin building resilience through nearshore solutions by shifting or sourcing business operations to nearby countries. Another 38% said they plan to build resilience through regionalization by organizing and managing supply chains to be self-sufficient within adjacent regions. In a similar survey conducted by Deloitte, 68% of executives across various industries also plan to build resilience through innovative “pandemic-proof” technologies that can automate production. Over the next few years, we’re likely to see a shift in manufacturing processes that will gradually become part of the standard business processes in the pharmaceutical industry.

The pharmaceutical supply chain during COVID: the example of insulin shortages

One of the most striking effects of the pandemic on the pharmaceutical industry was the series of global insulin shortages. With more than 420 million people worldwide living with diabetes, insulin is one of the world’s most widely used medicines. Because of its necessity, when medical supplies run low, insulin is often the first drug people start stockpiling, as their lives depend on its regular use. Given the additional complexity of the pharmaceutical industry, shortages can be caused by a variety of factors, including raw material procurement, production capacity, distribution constraints, and increased consumer demand.

During the pandemic, consumption patterns changed radically, leading to massive shortages. However, the virus didn’t cause people to become diabetic, so demand was a direct result of panicked stockpiling. This makes insulin shortages during the pandemic a good example of how easily consumer behavior can affect the ability of the pharmaceutical industry to meet a short-notice increase in demand.

First, let’s start by understanding how insulin is produced: We know it’s made by taking the human production gene for insulin and inserting it into a plasmid, a small circular DNA molecule found in bacteria and yeast. This retrofitted plasmid is then put back into the original bacteria or yeast, and it becomes a small insulin factory where medical manufacturers can harvest it to make the medication we know today. Manufacturers only need to provide ideal environments for the already-cultured yeast to grow and multiply, which makes it a cheap and effective medication to produce at scale.

Before the pandemic, Eli Lilly (one of the top 3 insulin manufacturers in the world) produced insulin batches every two weeks before bringing the medication to distributors. They were able to keep this same level of production thanks to manufacturing processes that naturally allow for safe distances between employees in open areas where the yeast tanks are located. Insulin demand also remains relatively stable as people take the medication regularly to maintain healthy blood sugar levels (although global demand is slowly rising).

Still, rumors began to spread of a mass insulin production collapse that would leave people without their life-saving medications. Many naturally began stockpiling. This left pharmacies worldwide temporarily out of stock as they ordered more supplies, which caused further stockpiling episodes, with people documenting their experiences of being unable to fill their prescriptions on social media.

With pharmacies sold out of insulin, some governments, like the United Kingdom, reacted by banning its export along with a list of other drugs impacted by consumer stockpiling. However, around the same time, the European Parliament stated that biological medicines (in the footnote, they clarify this as insulin) “have least often been indicated as in short supply (42 % of countries).”

Although countries in Europe reported that insulin was one of the drugs that were least often in short supply, many of the regional export bans and stockpiling in wealthy countries had an enormous impact on other parts of the world where insulin became “like gold.” Countries like Nigeria, which have less purchasing power than European countries, could not capture the supply that was being redirected to combat these shortages.

There was a spike in diabetes-related mortality during the pandemic, but it is difficult to determine whether the cause was a lack of medication or the pandemic itself, as diabetes is a major contributor to COVID-related deaths. A medical report published in 2022 by researchers found that there was a rise of about 30% in death rates among people with diabetes, with the greatest increase in young adults and those from ethnic minorities.

There was a spike in diabetes-related mortality during the pandemic, but it is difficult to determine whether the cause was a lack of medication or the pandemic itself, as diabetes is a major contributor to COVID-related deaths. A medical report published in 2022 by researchers found that there was a rise of about 30% in death rates among people with diabetes due to worsening glycemic control, with the greatest increase in young adults and those from ethnic minorities.

Even for those in countries with readily available insulin supplies, some could no longer afford their medication. An example can be seen in the United States, where people regularly cross international borders to buy from pharmacies that charge significantly less for insulin. After these borders closed due to the pandemic, they lost access to affordable healthcare options. In response, this group reacted by rationing insulin, often leading to serious medical complications, further escalating an already tense situation.

Insulin manufacturing companies were at a loss as to what to do in the face of surging demand, struggling with initiatives such as mail-order insulin services that were either not in the right geographic location or too expensive to meet the needs of those left on the sidelines. Thankfully, however, the insulin supply chain has stabilized recently, with no news of insulin shortages making national headlines.

The lasting effects of the pandemic on the pharma supply chain

Stockpiling medications like insulin was just one of the many changes that occurred in the pharmaceutical industry during the pandemic. The development, production, and distribution of the COVID-19 vaccine also created a new and increasingly complex environment that forced companies outside of the industry to rethink operational processes and objectives.

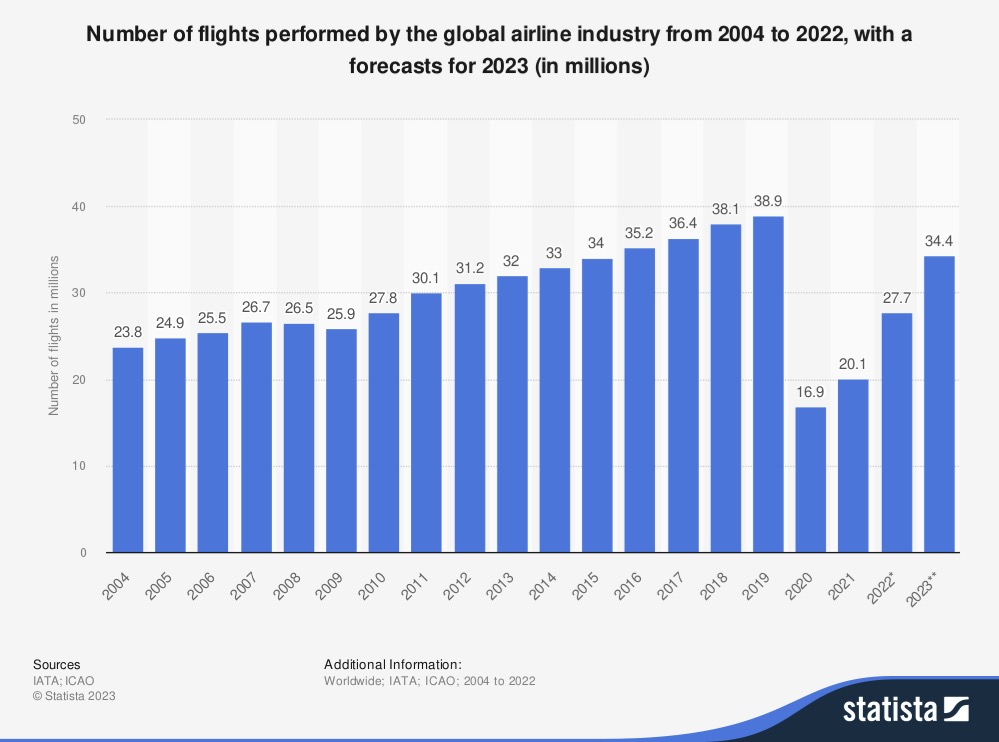

For example, in the aviation industry, companies such as Delta and American Airlines had to ensure that aircraft interiors were prepared for the shipment of Pfizer’s vaccine, which required temperature-controlled containers. For large companies that had spent decades designing aircraft to carry passengers, this was a major change, as they had to quickly adapt their strategies to recover from around two years of significant financial losses during the pandemic, from which some regions are still recovering.

Nevertheless, when American Airlines announced that it would put the Boeing 737 Max fleet back into service to help distribute the vaccine, their stock jumped 10% to almost pre-COVID levels. Doug Parker, chairman and CEO of American Airlines, said: “Half the cargo around the world flies in the bellies of commercial aircraft. So we’re all going to be critical pieces of this vaccine distribution.”

Pfizer’s vaccine had to be stored at -70°C, requiring a deep-freeze delivery chain. 5,000 doses were initially shipped in dry ice packs and had 10 days to reach a vaccination center, where they can be stored in a standard refrigerator at 2°C to 8°C for up to 5 days. However, once thawed, the vials cannot be refrozen. The Moderna vaccine, which requires a larger dose but can be stored at a standard freezer temperature of -20°C for up to six months, posed a similar but slightly less challenging problem.

New requirements for rapid vaccine delivery, distribution, and storage have led to dramatic changes in the global supply chain. The requirements for vaccine distribution have, for example, resulted in the cold chain market (responsible for keeping vaccines at consistent temperatures) potentially quadrupling in size from $280.2 billion in 2022 to an estimated $1,024.1 billion in 2031.

Startups reshaping the world of pharma logistics

The global pharmaceutical industry has undergone one of the greatest upheavals in recent history. The magnitude of the change is almost impossible for a single person to comprehend. Without taking the time to reflect on the intensity of these changes, many in the industry have attempted to return to business as usual. Fortunately, some startups have managed to weather the storm of the global crisis. They are actively working to reshape the industry in its aftermath.

This includes SkyCell, a Swiss company founded in 2013, which recently raised $67 million at a $600M valuation to build containers to transport pharmaceuticals. Their lightweight containers provide security to fragile medical supplies while also keeping them at a consistent temperature.

Luo Automation, founded in 2019 in the Netherlands, helps to relieve the labor-intensive task of medical supply inspection through a visual assistant. Their competitor, Deevio, a Berlin-based company founded a year earlier in 2018, offers an AI alternative to their visual inspection assistant and was recently acquired by wenglor, which offers smart sensor solutions for industrial applications.

Also founded in 2019 is the New York-based company Leucine, which speeds up manufacturing processes for the pharmaceutical industry through the help of an AI copilot that monitors compliance processes.

Holocene, a Beam startup founded in 2022, optimizes international compliance management in the healthcare and pharmaceutical industries through robotic process automation (RPA). This enables major regulatory changes to trigger automated decision-making, enabling companies to become more agile.

Countercheck, a Beam startup founded in 2021, detects counterfeit pharmaceutical products. The company’s software upgrades existing hardware to detect products not from the original manufacturer, preventing counterfeit drugs from entering the market.

Do you have a unique, non-obvious solution that addresses today’s pharmaceutical logistics challenges? Share your idea with us, and we may be able to provide the support you need to turn it into a startup!