Nations globally are pushing for the development of green technologies to meet upcoming climate targets and keep temperatures within the 2°C threshold outlined in the Paris Agreement. Given the limitations of current freight systems, the expansion of rail freight is essential to meeting these ambitious carbon reduction goals. With new legislation and financial support on the horizon, rail freight is poised to revolutionize modern logistics.

Recent sustainability legislation pushing rail as the primary freight mode is also well-founded. In 2023, the European freight industry will account for 30% of the EU’s transport emissions, with an expected increase of 25% by 2030 and 50% by 2050. The European Commission is implementing strategies to shift freight from road and air to rail networks to combat continued levels of transport emissions, deliberately changing existing logistics practices. This strategic shift is often seen as the beginning of a “rail revolution,” focusing on high-tech innovations such as automated electric railcars and converting diesel engines to hydrogen-powered batteries in areas without options for electric rail.

As one of the earliest modes of transportation, rail remains a symbol of reliability and efficiency. This resilience has been tested by the many global disruptions of the past decade, from the pandemic and war in Ukraine to the increasing pressures of climate change, when rail was often the only freight mode that could reliably deliver goods. In contrast to the challenges facing air and road freight when meeting sustainability goals and adapting to regional crises, rail has consistently proven to be the most resilient and environmentally friendly option for moving goods per tonne and per kilometer traveled — surpassed only by waterborne transport over substantially longer distances.

While the global logistics landscape continues to evolve, key regions such as Europe, China, South Korea, the United States, Australia, New Zealand, and others are increasingly channeling resources into sustainable transportation projects. One example of this shift is the European Union’s Horizon Europe project. With a budget of more than €92 billion for 2020-2027, it encourages the development of technologies that address climate change, focusing specifically on the logistics industry.

The Horizon project’s scope is embedded in Europe’s Rail initiative, which has allocated €594.8 million to 14 different projects. Its main objective is to incentivize logistics and supply chain actors to shift their freight from road and air to more eco-friendly rail freight. This investment complements another significant effort to create a Single European Railway Area, which aims to harmonize rail infrastructure across Europe. By enabling trains to travel longer distances, this initiative is designed to make rail freight more competitive compared to road and air freight. The anticipated improved cost-effectiveness of rail freight in Europe should, according to this new funding, lead to a market preference for rail as a more cost-effective as well as environmentally friendly alternative.

Can rail freight outperform other transportation alternatives in terms of resilience?

Despite major legislative efforts and significant funding to promote rail freight as a more sustainable and reliable option compared to air and road freight, a key question remains: Can rail freight achieve a level of competitiveness high enough to withstand the harsh market conditions of recent years?

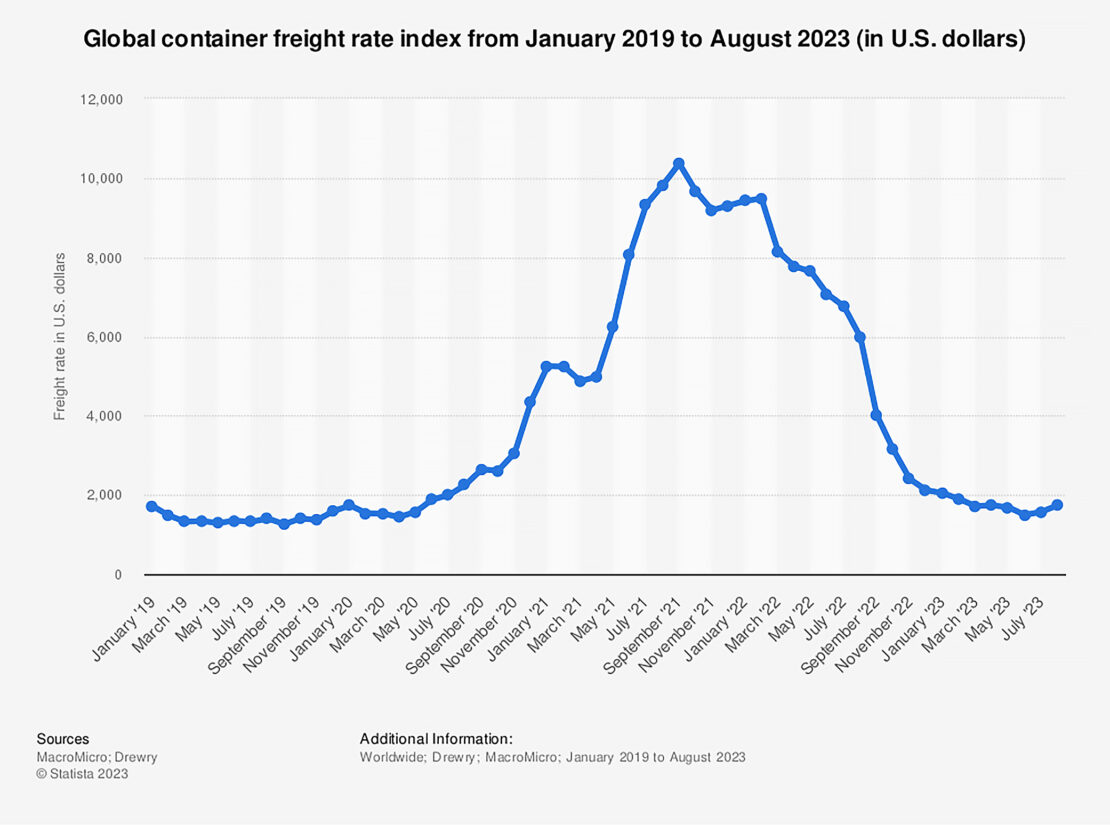

To answer this question effectively, it’s helpful to consider the second most sustainable mode of transportation: waterborne freight. Between 2021 and late 2023, this market experienced significant price volatility as a direct result of evolving global trade. To understand how these dynamics changed, it’s important to consider how waterborne freight operates: Containers are typically loaded to capacity at one location and then reloaded at the next destination once the original goods have been delivered — a critical driver behind its efficiency.

The recent shift in the market that disrupted this stability can be attributed to changes in consumer behavior in 2021, which resulted in many containers remaining idle. This triggered dramatic price increases in some parts of the world, where rates jumped from $1,200 to $6,000 — a fivefold increase. Two simultaneous factors caused this situation during the pandemic: (1) Government-sponsored economic measures during the pandemic stabilizing import activity and (2) reduced spending where these measures were not in place. As a result, containers arriving full in countries with active government spending initiatives during the pandemic often had no exports to carry on the return trip. These containers then had to be shipped back empty.

The crisis peaked towards the end of 2021. This was followed by a rapid spiral in container freight rates from January 2022 to mid-2023, marking the beginning of a second wave of instability triggered by the market’s re-stabilization due to a return to pre-pandemic consumer behavior. This rapid change forced container shipping companies like Hapag-Lloyd and Maersk to adjust their strategies quickly. Most notably, Hapag-Lloyd decided to reduce services on several routes as a cost-cutting measure. At the same time, Maersk announced a significant reduction of 10,000 jobs to adapt to these changing market conditions.

During the pandemic, it wasn’t only waterborne freight that faced obstacles; road freight also experienced a series of unique challenges. For example, the United States, a country heavily dependent on road freight, saw the market undergo a dramatic shift. The unique conditions created by the pandemic caused traditional shipping relationships to flip from shippers setting the rates for carriers to carriers setting them for shippers.

FreightWaves, a leading transportation magazine, identified stimulus checks issued to US citizens as a key factor. These checks contributed to a surge in consumer orders in the second half of 2020, which had a significant impact on relationships in the trucking sector:

“Many companies reportedly went to carriers with self-implemented rate increases in attempts to lock down more capacity. This is not a standard practice as shippers typically hold the upper hand in negotiating with carriers due to the highly competitive trucking environment. Carriers bid for shippers’ freight in most cases, not the other way around.”

Ultimately, this caused a 12% year-on-year increase in road freight shipping rates from 2019 to 2020.

This change didn’t last either. It was followed by a similar collapse to the waterborne container freight market once the market restabilized. The impact could be seen in the closure of well-funded companies such as Convey, which raised an impressive $260 million in Series E funding just a year and a half before shutting down. This downturn isn’t limited to just start-ups, as DHL Logistics reflected in their Road Freight Market Report for Q3 2023. While capacity has normalized compared to the pandemic, road freight rates remain high. This is largely due to ongoing factors such as rising diesel costs, higher tolls, and the required shift towards sustainable technology investments, revealing an industry in the midst of adapting to rapidly changing economic and environmental landscapes.

So, to answer the question of whether rail freight offers market resilience beyond reduced carbon emissions compared to other transportation methods, the answer is yes. Rail freight experienced surprising levels of stability during periods when road and waterborne freight options were limited due to changes caused by the pandemic. This shift was particularly evident among exporters looking for reliable transportation alternatives when their traditional shipping options were unavailable. However, it’s important to remember that this relative stability was actually quite impressive in the context of a much weaker global economy. Professor Andreas Breinbauer, Vice Chancellor and Head of Logistics and Transport Management at the University of Applied Sciences BFI Vienna, also explained that despite the shift from other modes of transportation to rail as a reliable alternative, it was still a challenging period for the industry as a whole as there was a significant decrease in overall spending.

In the aftermath of the pandemic, the world is now adding sustainability and carbon reduction requirements to the mix, which will add even more complexity to the logistics industry in the coming years. Not only are these regulations an environmental must, but they are also driving fundamental changes in the industry. They require a reevaluation of existing practices and encourage the adoption of greener approaches. As the industry navigates these changes, it will redefine how supply chains are organized — combining efficiency with environmental responsibility in a rapidly evolving global context.

Creating additional resilience for rail freight through green policies

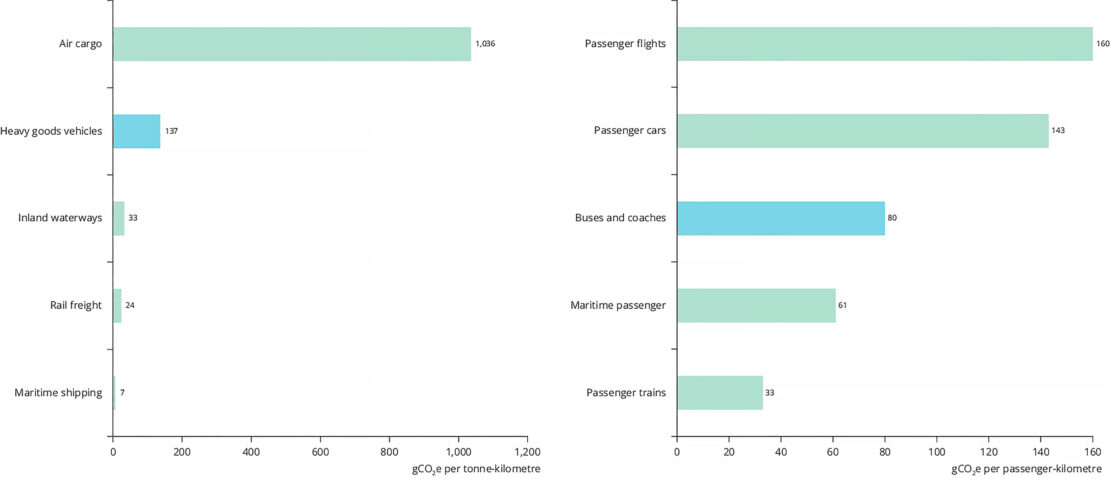

Rail’s resilience during the pandemic is not its only advantage over other freight alternatives. It also has the advantage of being the most efficient mode of transport per tonne-kilometer traveled, allowing the rail industry to capture a large amount of funding from sustainability initiatives. This aligns with the goals of the European Green Deal, a comprehensive framework that allocates €600 billion to develop new policies in energy, transport, and taxation. The goal is to significantly reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990. This is in addition to establishing the European Union as the world’s first carbon-neutral continent by 2050 through the decoupling of growth from resource exploitation, including fossil fuels.

The initial strategy for the European Green Deal, outlined by the European Commission in 2020, identifies a significant environmental challenge: nearly 25% of carbon emissions are generated by transport systems, including passenger travel and the global supply chain. To meet the 2050 carbon neutrality targets, a 90% reduction in transport emissions is required. This is where rail stands out for its efficiency, producing on average only one-fifth the carbon emissions per tonne-kilometer compared to road freight. This significant difference is why improving and expanding rail networks is a key focus for the EU’s sustainability initiatives.

Greenhouse gas emission efficiency of different transport modes for freight (left) and passenger (right). European Environment Agency 2022.

Upcoming changes in green policies will undoubtedly affect all modes of transportation. This legislation is expected to challenge less efficient methods, such as air and road freight, while favoring those with lower emissions, such as rail and waterborne freight. As a result, the strategy promoted by the European Environment Agency aims for a significant increase in the rail freight market, with a target 50% increase by 2030 and a doubling by 2050. Similar growth is forecast for inland waterways and short sea shipping, with targets of 25% and 50% by 2030 and 2050, respectively. As the global supply chain is unlikely to meet these demands, road and air transport could potentially lose some shipping partners to rail and sea alternatives as they offer a more competitive market environment created by new regulations.

The European Commission’s strategy also includes the use of green hydrogen (now renamed clean hydrogen). It’s a shift that was backed by the formation of the European Clean Hydrogen Alliance in 2020. This move toward hydrogen-powered trains offers an even greener alternative for rail freight, bypassing the somewhat disputed issue of forced electrification among rail operators. For example, in 2023, European operators criticized mandates for electrification, arguing that it could unintentionally harm green initiatives. They also pointed to the underdeveloped state of electric HGV (Heavy Goods Vehicles), which makes traditional non-electric rail transport more eco-friendly than the current state of road freight. It’s important to note that these mandates would impact a minority of rail traffic as 50% of Europe’s railways are electrified, and 80% of rail transport runs on electricity.

Hydrogen-powered trains, on the other hand, can be retrofitted with hydrogen-powered engines. They allow rail operators to retain their existing fleet while operating on non-electrified railways, which is easier than manufacturing new electric trains or electrifying low-traffic routes. With Ireland retrofitting trains with hydrogen fuel cells and the European Union putting billions into updating existing rail infrastructure, the future of rail points to a potential mix of these technologies.

Rail freight startups to watch out for in 2024

While the logistics industry, particularly the rail freight sector, has long had a reputation for being conservative due to its centuries-old history, there is a shift taking place through a noticeable increase in startup funding targeted specifically at the adoption of disruptive technologies. This influx of capital and innovation is a much-needed catalyst for revitalizing the industry’s aging infrastructure.

Not only are these startups challenging traditional norms with their fresh perspectives and new solutions, but they are also essential in bringing a new wave of modernization to an industry that has relied on long-established practices and legacy technologies. Their presence and success in driving innovation in this sector signals a critical shift, bridging the gap between the industry’s traditional practices and the demands of a rapidly evolving global marketplace.

Want to learn more about startups in this area? Here are to watch out for in 2024:

Founded in 2020, German startup Rail-Flow aims to transform the rail freight industry by digitizing rail tenders and facilitating the shift from road to rail freight. In May 2023, Rail-Flow secured €3.6 million in a seed funding round, a move designed to expand its operations across Europe.

Meanwhile, companies like Konux (2014), Neuron Soundware (2016), and AxoTrack (2022) are using artificial intelligence to detect malfunctioning track and train components via sound waves and sensors.

Canadian startup Railvision, founded in 2018, is attempting to save fuel and energy costs by integrating AI into existing management systems in a company’s fleet. They’ve already completed one successful seed round of $4 million (USD) in 2022, led by Trucks Venture Capital.

Founded in 2020, Intramotev has developed an electric, autonomous rail freight car that could save hundreds of thousands of tons of carbon emissions by shifting freight from truck to rail.

With more than 700 rail startups worldwide tackling issues such as rail delays, track obstructions, and capacity management, these examples are just a handful of the companies that are looking to — perhaps not systematically reinvent, but rethink — how we can modernize the freight industry.

Want to join these startups in revolutionizing the rail industry? Pitch your idea to BEAM; we might be interested in supporting your journey!