Navigating Supply Chain Transparency: An Indicator of Where Startups Can Shine?

Over 60% of supply chain firms are looking to adopt cutting-edge inventory and network optimization tools in the coming years, much of them in the near term (35% in the next 1-2 years). Will these businesses overcome the impasse between planning and execution, lining up a possible paradigm shift in supply chain management? And do startups have a say in it all?

Whether it’s a birthday gift shipped from an e-tailer that simply cannot arrive late or a container shipment to a new trading partner: a more transparent supply chain is a more successful supply chain. From improving the customer experience for the e-commerce shopper to allowing the new trading partner to adapt to unexpected delays, visibility wins every time.

79% of companies with high-performing supply chains achieve revenue growth greater than the average within their industries.

What sounds like another wonderfully obvious potential outcome of digitization is, however, often still a pipe dream when considering the reality on the ground. Consider the starting point of the purchasing supply chain, order management. A recent study suggests that, in Germany, 42% of SMEs still handle this manually. And they are in good company. Indeed, 90% of businesses previously named digitization as a key force in the evolution of the modern supply chain. However, over half of these businesses do not have a plan in place to pursue digitization in a meaningful, strategic manner, in spite of the demonstrable promise it holds.

As implementing digitization remains a challenge, so does supply chain visibility. About one in five companies listed visibility as their number one operational challenge. And, in line with the overall absence of digitization strategies, 60% admitted that they didn’t use technology to monitor their supply chain.

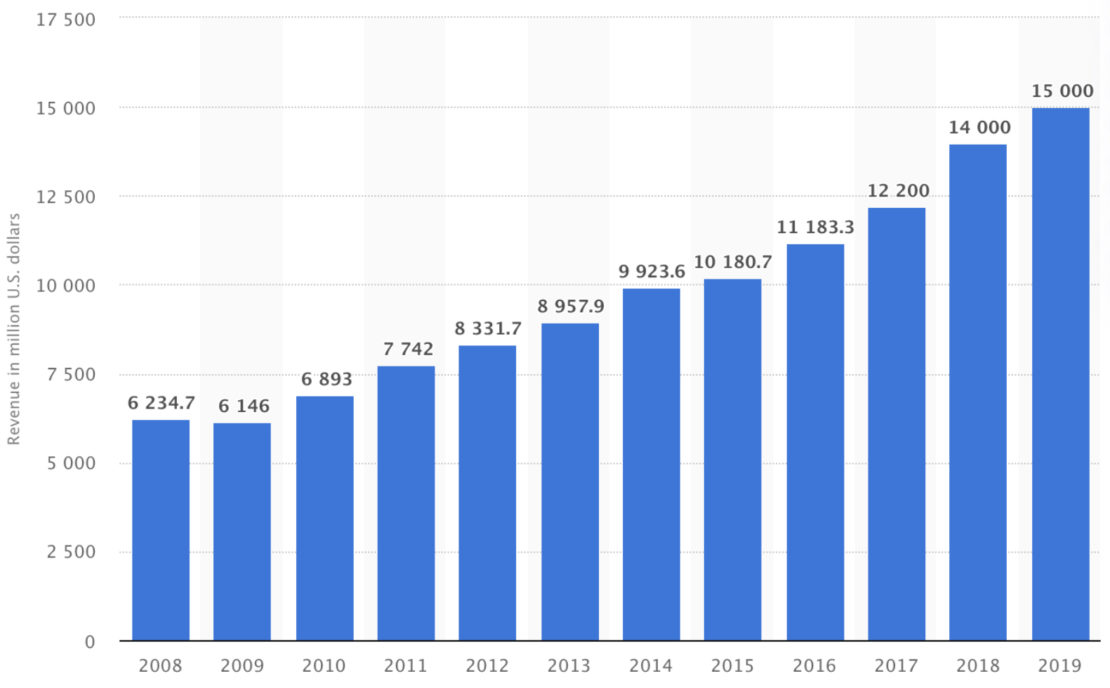

Where some see operational challenges, others inevitably see opportunity. And so, between 2009 and 2019, revenues for supply chain management (and procurement) software grew from $6.1bn to $15bn annually.

The potential for disruption in supply chain management is very much perceived as being located within the inventory and network optimization space. Yet the supply chain management software space remains very much a segment dominated by non-disruptor types. Enterprise software giants such as SAP and Oracle alone claim almost 74% of the market’s revenue (when discounting procurement software). As such, the path to scale for start-up solutions is often via partnerships with one of these incumbents.

To this end, SAP recently announced a partnership with Bay Area-based startup ClearMetal, focusing on Continuous Delivery Experience or CDX. The joint tech venture aims to turn the vast amount of data points along a transportation route into supply chain optimizing decisions using machine learning algorithms. Effectively, this marks a paradigm shift for supply chain tools, moving from decision-support to decision-making.

This shift is indicative of the potential to enter and scale in the logistics industry without asset heavy business models that have traditionally served as a barrier to entry. Customer expectations continue to shift towards favoring technology-driven offerings. The question of whether peak asset-based dominance has been reached and surpassed is on the table. Supply chain transparency is a key indicator of a possible customer-based dominance that startups can now begin to thrive upon.