The traditionally risk-averse logistics industry has been slower to innovate than other sectors — far off the pace of the Health and Fintech industries, for example. True, we’ve seen some new technologies begin to disrupt matters in recent years, but it has been the pressure placed on supply chains by the Covid-19 pandemic that has cast new light on the need for automation and digitization.

Logistics tech startups are starting to come of age.

Having been a growing target for venture capital over the last half-decade in particular, the number of investment deals in logistics is on track to increase by12% compared to last year. From robotic fulfillment, predictive inventory forecasting, digital freight forwarding, and returns optimization, new logistics tech companies have the power to revolutionize supply chains and boost efficiency — ensuring goods get where they need to be quicker than ever, improving capacity utilization, and tracking it all in real-time along the way.

Let’s talk money.

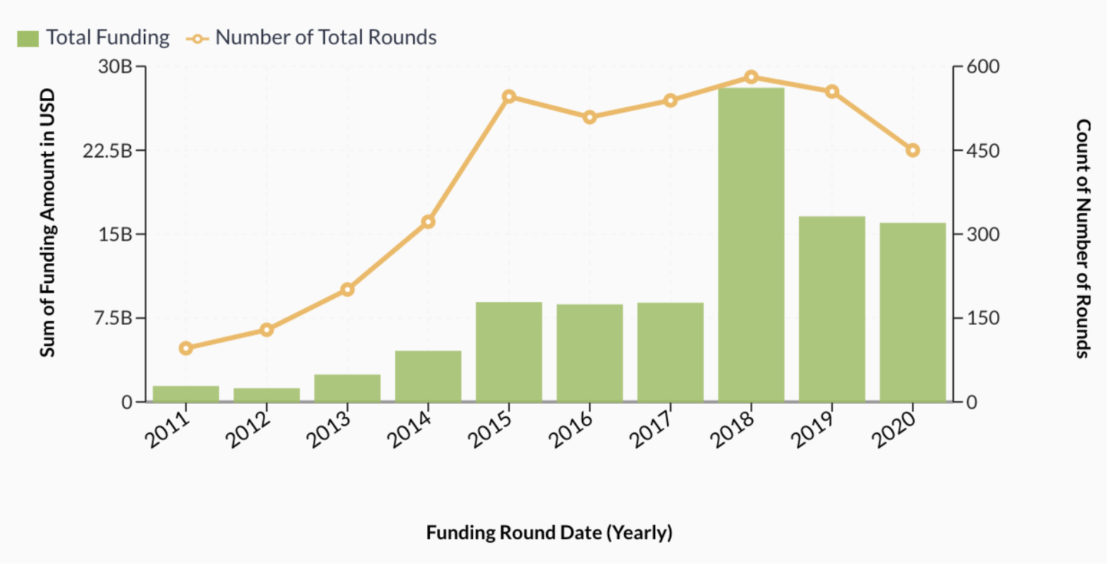

In the US, VCs have invested over $60 billion in logistics startups since 2018. While the pace has slowed a little this year, total funding volume is still on par with 2019, both years representing nearly double the industry’s volume only just 3 years ago.

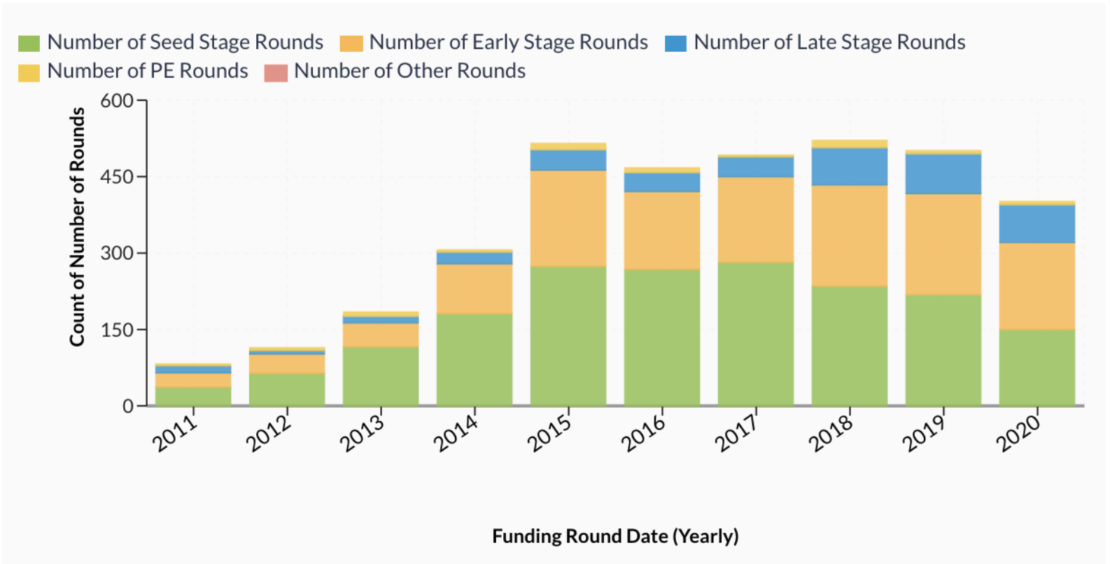

What’s more, although funding round numbers have dipped somewhat during the pandemic, the number of startups receiving late-stage funding has remained consistent while seed-stage rounds decreased noticeably – a solid, ongoing indicator that the startup sector is beginning to mature, allowing VCs to move their investments to safer harbors in uncertain times.

So, where’s the money being spent?

It’s not really surprising that given the consumer behavioral shift from in-store to online purchasing over the past few years, startups offering last-mile delivery services have captured the lion’s share of funding, around $11.1 billion in 2018, or 39% of that year’s total. Of that, 90% went specifically to companies offering innovative delivery methods, leveraging drone or autonomous vehicle technology.

We’ve also seen an influx of last-mile startups shooting up around the Asia–Pacific region, with Delhivery and Xpressbees offering new distribution networks to India after having raised over $1.1 billion between them since 2019.

Technological innovation may have been slow off the mark in the logistics sector, but has been making up for its reluctant beginnings in recent years. Investments in Supply Chain Visibility (SCV), analytics platforms, autonomous vehicles and warehouse robotics, are already making their optimizing mark on supply chains. Amazon, for example, was able to reduce its operating costs by 20% by investing in Kiva Robots. The robots fulfill one-click orders in just 15 minutes — about 4 times quicker than a human doing the same job.

It comes as no surprise then that by 2023, at least 50% of large global enterprises are expected to be using technological innovations like artificial intelligence, advanced analytics, and the internet of things in their supply-chain operations.

Investments driven by Asia, US

The vast majority of funding is being invested in startups across the US and Asia. Last year, China received 40% of the total funding for logistics startups, with the US following closely behind at 35%. India and Asia-Pacific received 9% and 8%, respectively, while Europe trailed behind significantly with just 5%.

SoftBank Group Corp., the Japanese multinational conglomerate which runs Vision Fund (the world’s largest technology-focused VC fund), has made significant investments in both the US and China. Through its Vision Fund 2, it led a $113.5 million investment in Flock Freight — a US software startup that matches trucks with freight headed in the same direction — earlier this year. SoftBank has placed a notable focus on logistics tech in its recent investment moves, which included a share in the $1.7 billion financing for Chinese startup Full Truck Alliance. The Chinese ‘Uber for trucks’ offers a mobile app matching truck drivers and merchants transporting cargo and also provides financial services to truckers.

So, what happens next?

Logistics startups are facilitating digitization and innovation across the industry. As we look to 2021, we expect to see the startup maturity curve continue to rise. Concretely, this will mean more of the larger funding rounds that will serve to scale the technologies that have been able to demonstrate a solid track record in recent years: product-market fit, scalable tech, and crisis-proof business models. The stage has been set. The second act is about to begin.