Delivering the (fake) Goods: Thriving Counterfeit Trade and Lacking Tech Solutions

The counterfeit goods trade is booming. Conditions for it to continue flourishing, such as the rapid rise in e-commerce and new trade routes, are also being met. No less, customs officials in Europe are faced with a barrage of 1.1 billion international inbound parcels annually. Are tech solutions the only answer?

A global industry that has grown to 100 times its size of just 20 years ago. Add to that a market share of 7% of all imported products into Europe. Does that sound like a market you want a piece of? Most definitely not! As these are the (unfortunately) impressive figures of the counterfeit goods trade.

Counterfeiters originally focused on traditional, high-end consumer fakes – particularly watches, perfumes and leather goods. Today, the product palette extends across the board: electronics, toys, car parts and pharmaceuticals as well as food items now all form a part of the trade in fake goods.

To this end, the EU Intellectual Property Office (EUIPO) recently teamed up with its South-East Asian counterpart (IP Key SEA). The goal is to fund a €7 million initiative to support intellectual properties (IP) right protection and enforcement across Southeast Asia. The desired outcome is to foster the appropriate legal and economic environment conducive to legal trade and transparent investment in the region and is one of numerous international efforts to combat counterfeit commerce.

Just four categories of goods make up nearly two thirds of the total counterfeit trade. The share of seizures is topped by footwear (22%) and followed by clothing (16%), leather goods (13%) and electrical equipment (12%).

The counterfeit value chain has become highly sophisticated at every link in its chain. From websites and e-commerce platforms to forged trademarks and labels all the way to transit route planning, counterfeiters are not deterred by the requirements to commercialise and transport their illegal inventories. On the contrary, with overland rail logistics facilitating trade between the counterfeit hubs in China and European markets, delivery time of goods can be reduced from an average of 45 to just 10 days.

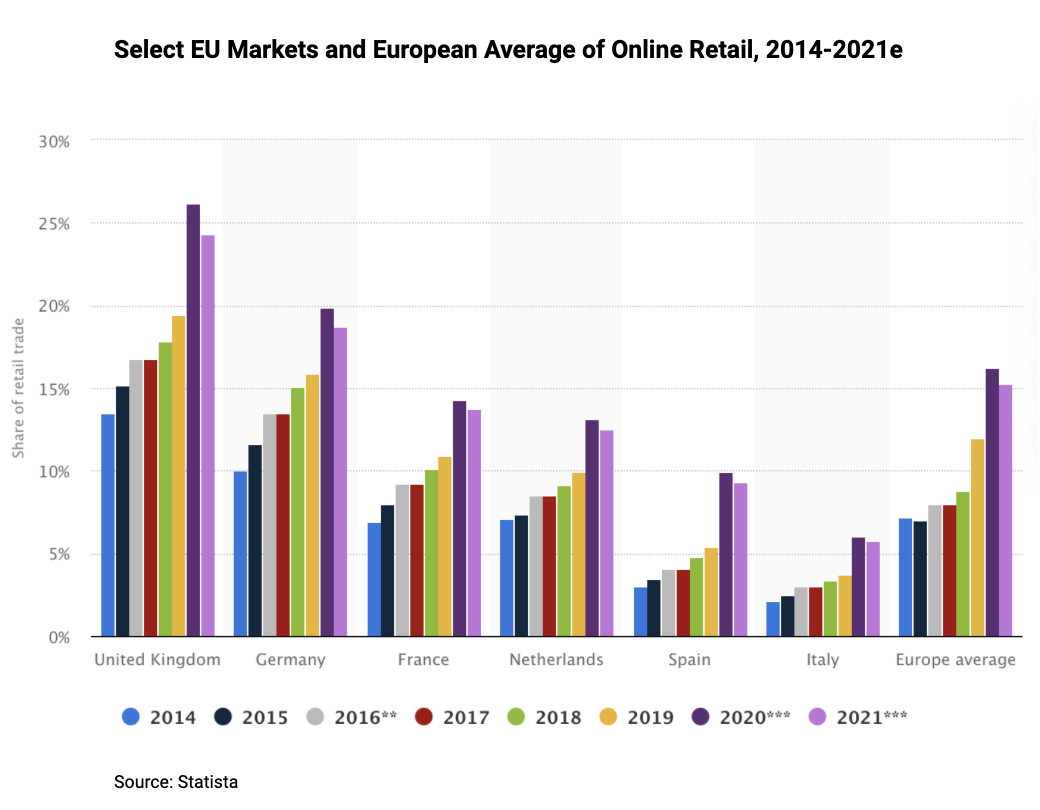

Accelerated delivery is met with consumer behavior as online retail goes from strength to strength. Considering that 2020 levels of online retail are a solid indicator of a revised base load activity for future e-commerce, counterfeiters from abroad are looking at considerable potential to continue flourishing. Although Europe’s leading economies still vary widely in terms of the online share of retail trade in 2019, the trend is undeniable. At the lower end, Italy hovers at under 5% of the online share of retail trade. By contrast, the UK nearly broke the 20% barrier in the same year. The European average, meanwhile, sits comfortably above 10% and is expected to remain near or above 15% going forward.

So, if the requirements to commercialize and transport fake goods do not pose a barrier to entry, and the combined framework of inter-continental rail logistics networks and scaling e-commerce adoption point to a likely increase in counterfeit trade, what are the solutions to combating this trade more effectively?

Clearly, customs officials are overwhelmed with the task at hand. At an estimated 1.1 billion international inbound parcelsarriving in Europe annually during pre-pandemic times (2018), no amount of analog manpower could put a significant enough dent into the problem.

As a result, tech companies, from bootstrapped startups to major corporates, are eagerly developing supply chain transparency solutions, with several options on the table from Continuous Delivery Experience (CDX) to smart contract technology. According to an SAP-run surveyof 200 customers and partners in their Blockchain Community, supply chain management was perceived far and away as the most promising use case for blockchain technology at 63%, followed by legal/regulatory (19%) and cryptocurrency (8%). Smart contract technology and sensors fitted to packages to detect compliance metrics like quality requirements sound promising but not without their fair share of complexity in terms of implementation. Not to mention that without additional policy enforcements, bypassing this potentially more costly option remains all too easy.

Raids and undercover work remain the cat-and-mouse state of play as things stand, and that means brands and the brand protection managers they employ will have to continue the risky, difficult work to fight the good fight. In closing, we recommend this insightful TED Talk by Tommy Hilfiger’s brand protection manager, Alastair Gray, as he delves into the undercover work that shows just how far brands are willing to go.