Is speed forever and only the big differentiator when it comes to delivery options? Glovo, the speedy Spanish courier service, secured €450 million ($530m) in Series F funding in April, which sees it continue its meteoric rise since its founding in 2015. On-demand grocery delivery firm Gorillas, meanwhile, jumped to a €2bn ($2.3 bn) valuation in September after a close-to €900m investment near the end of the month – a €1bn increase compared to where they were just in March of this year. Such a swift rise in value is apt for companies that pride themselves on speedy grocery delivery. But is fast delivery the only important factor here, and the only creator of opportunity? It really depends on the segment.

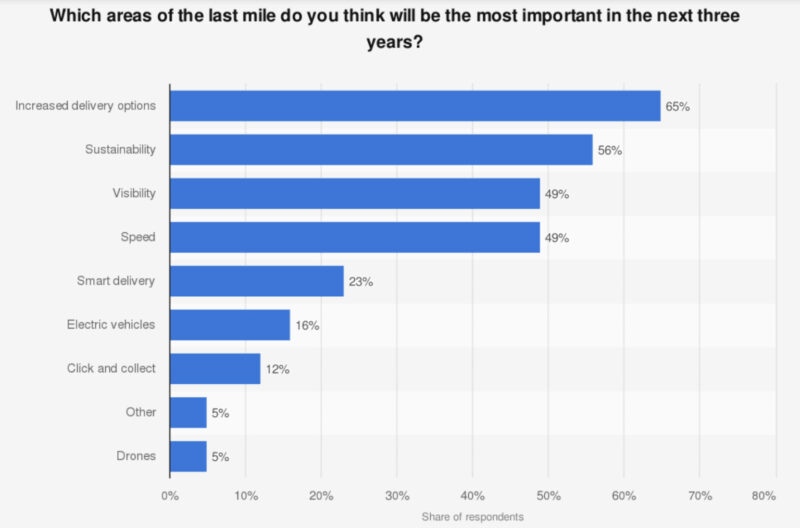

Source: Statista

One recent survey, for example, (see chart below) ranks speed as the third equal most important area in last-mile delivery over the next three years alongside visibility, and below sustainability and increased delivery options. What’s more, a 2018 study revealed that the maximum average delivery time consumers will wait dropped from 5.5 days in 2012 to 4.5 days, and that swift, free delivery is increasingly becoming an expectation rather than an added incentive. With that in mind, let’s take a look at 3 innovators that go beyond the fixation of getting products into the customer’s hands as quickly as possible. Instead, these players are looking to entrench their defensibility through added value, such as hardware development or customized end-user experience.

Smart delivery versus fast delivery

Mobile retail firm Enjoy prioritizes a seamless, smart user experience over fast delivery. They enable personalized delivery by experts from tech firms (and in the future possibly also luxury brands). This means that, instead of the anonymous DHL and Amazon-type deliveries we’re all used to, the last mile is turned into an opportunity for brands and an enhanced experience for customers. Run by Ron Johnson, the brains behind Apple’s ‘Genius Bar’ and ex-CEO of JC Penney, the company’s revenue is expected to rise to $109 million this year from $15 million in 2018, according to Securities and Exchange Commission filings. The company expects to be profitable in 2023 and it has told investors it plans to reach $1 billion in sales by 2025. Headquartered in Palo Alto, California, the company says it is disrupting the physical retail model by turning the impersonal delivery experience of Q-commerce into an opportunity.

Bringing delivery services to vendors’ doors

In a similar vein to Enjoy, Wing, which is a subsidiary of Google parent company Alphabet Inc., makes it easier for sellers to connect with customers at the same time as providing a seamless user experience. The delivery platform provides a clever twist by essentially bringing its service straight to the doorstep of sellers. The company flies delivery drones from the rooftops of shopping centers, allowing a great number of sellers to easily send deliveries from their location. It has already completed over 100,000 deliveries of food products such as sushi, bubble tea, and smoothies, and it also recently started delivering over-the-counter medicines as well as beauty products. The firm gained approval from Australia’s Civil Aviation Safety Authority in 2019 and its battery-powered drone delivery will help to cut down on last-mile emissions.

Autonomous robots for fast, clean delivery

As autonomous delivery robot firm Starship points out, robots don’t just make deliveries quicker, they also make deliveries cheaper, smarter, and more sustainable. Critically, in times of lingering – and potential future – pandemics, they also make deliveries contactless. Starship was founded in 2014 by Skype co-founders Janus Friis and Ahti Heinla. Earlier this year, the startup announced an additional $17 million in funding which secured them important strategic backers, Goodyear Ventures. Their total funding amount now sits at $74 million. In May of this year, Starship announced a partnership with Costa Coffee to test coffee robot delivery in Milton Keynes in the United Kingdom. In September, they expanded their offering into the grocery delivery space by partnering with Co-op, the UK food retailer. Starship is part of the wider trend of green delivery and serves as another key example that highlights factors that make up the trade-off with speed: in this case, cost and sustainability.

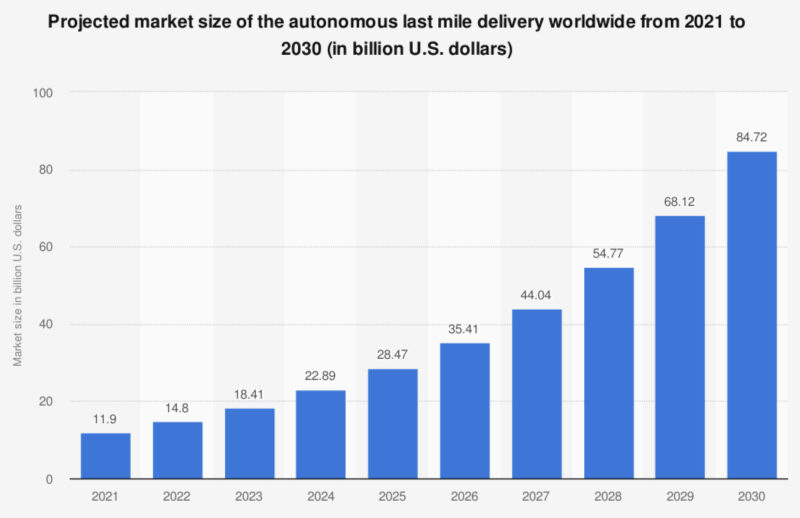

Source: Statista

Smart and steady wins the race

Starship’s rollout may be confined to small-scale and pilot-type projects – but they are no outlier. As the chart above shows, the size of the autonomous last-mile delivery market is predicted to increase nearly 8-fold to $84.7 billion by 2030. With so many companies getting in on the action, it will be increasingly difficult to differentiate a last-mile delivery platform via speed, as a wealth of options will make it harder to stand out in the market. When it comes to less time-sensitive items like gadgets or apparel, firms are gaining a lead on their competition by not only focusing on speedy delivery times in order to provide added incentives for both sellers and buyers to use their platform.